Podcasts are bouncing back from last year’s slowdown with digital audio publishers, tech partners and brands innovating to build deep relationships with listeners.

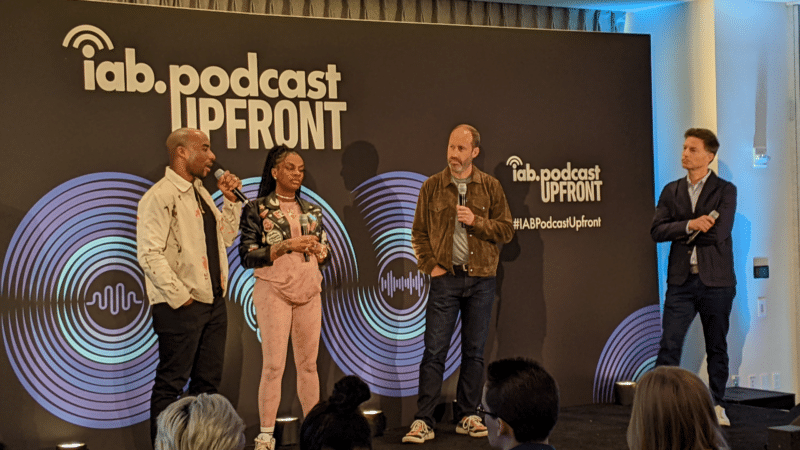

At the IAB Podcast Upfronts in New York this week, hit shows and successful brand placements were lauded. In addition to the excitement generated by stars like Jon Stewart and Charlamagne tha God, the numbers gauging the industry also showed promise.

U.S. podcast revenue is expected to grow 12% to reach $2 billion — up from 5% growth last year — according to a new IAB/PwC study. Podcasts are projected to reach $2.6 billion by 2026.

The growth is fueled by engaging content and the ability to measure its impact. Adtech is stepping in to measure, prove return on spend and manage brand safety in gripping, sometimes contentious, environments.

“As audio continues to evolve and gain traction, you can expect to hear new innovations around data, measurement, attribution and, crucially, about the ability to assess podcasting’s contribution to KPIs in comparison to other channels in the media mix,” said IAB CEO David Cohen, in his opening remarks.

Comedy and sports leading the way

Podcasting’s slowed growth in 2023 was indicative of lower ad budgets overall as advertisers braced for economic headwinds, according to Matt Shapo, director, Media Center for IAB, in his keynote. The drought is largely over. Data from media analytics firm Guideline found podcast gross media spend up 21.7% in Q1 2024 over Q1 2023. Monthly U.S. podcast listeners now number 135 million, averaging 8.3 podcast episodes per week, according to Edison Research.

Comedy overtook sports and news to become the top podcast category, according to the new IAB report, “U.S. Podcast Advertising Revenue Study: 2023 Revenue & 2024-2026 Growth Projects.” Comedy podcasts gained nearly 300 new advertisers in Q4 2023.

Sports defended second place among popular genres in the report. Announcements from the stage largely followed these preferences.

Jon Stewart, who recently returned to “The Daily Show” to host Mondays, announced a new podcast, “The Weekly Show with Jon Stewart,” via video message at the Upfronts. The podcast will start next month and is part of Paramount Audio’s roster, which has a strong sports lineup thanks to its association with CBS Sports.

Reaching underserved groups and tastes

IHeartMedia toasted its partnership with radio and TV host Charlamagne tha God. Charlamagne’s The Black Effect is the largest podcast network in the U.S. for and by black creators. Comedian Jess Hilarious spoke about becoming the newest co-host of the long-running “The Breakfast Club” earlier this year, and doing it while pregnant.

The company also announced a new partnership with Hello Sunshine, a media company founded by Oscar-winner Reese Witherspoon. One resulting podcast, “The Bright Side,” is hosted by journalists Danielle Robay and Simone Boyce. The inspiration for the show was to tell positive stories as a counterweight to negativity in the culture.

With such a large population listening to podcasts, advertisers can now benefit from reaching specific groups catered to by fine-tuned creators and topics. As the top U.S. audio network, iHeartMedia touted its reach of 276 million broadcast listeners.

Connecting advertisers with the right audience

Through its acquisition of technology, including audio adtech company Triton Digital in 2021, as well as data partnerships, iHeartMedia claims a targetable audience of 34 million podcast listeners through its podcast network, and a broader audio audience of 226 million for advertisers, using first- and third-party data.

“A more diverse audience is tuning in, creating more opportunities for more genres to reach consumers — from true crime to business to history to science and culture, there is content for everyone,” Cohen said.

The IAB study found that the top individual advertiser categories in 2023 were Arts, Entertainment and Media (14%), Financial Services (13%), CPG (12%) and Retail (11%). The largest segment of advertisers was Other (27%), which means many podcast advertisers have distinct products and services and are looking to connect with similarly personalized content.

Acast, the top global podcast network, founded in Stockholm a decade ago, boasts 125,000 shows and 400 million monthly listeners. The company acquired podcast database Podchaser in 2022 to gain insights on 4.5 million podcasts (at the time) with over 1.7 billion data points.

Measurement and brand safety

Technology is catching up to the sheer volume of content in the digital audio space. Measurement company Adelaide developed its standard unit of attention, the AU, to predict how effective ad placements will be in an “apples to apples” way across channels. This method is used by The Coca-Cola Company, NBA and AB InBev, among other big advertisers.

In a study with National Public Media, which includes NPR radio and popular podcasts like the “Tiny Desk” concert series, Adelaide found that NPR, on average, scored 10% higher than Adelaide’s Podcast AU Benchmarks, correlating to full-funnel outcomes. NPR listeners weren’t just clicking through to advertisers’ sites, they were considering making a purchase.

Advertisers can also get deep insights on ad effectiveness through Wondery’s premium podcasts — the company was acquired by Amazon in 2020. Ads on its podcasts can now be managed through the Amazon DSP, and measurement of purchases resulting from ads will soon be available.

The podcast landscape is growing rapidly, and advertisers are understandably concerned about involving their brands with potentially controversial content. AI company Seekr develops large language models (LLMs) to analyze online content, including the context around what’s being said on a podcast. It offers a civility rating that determines if a podcast mentioning “shootings,” for instance, is speaking responsibly and civilly about the topic. In doing so, Seekr adds a layer of confidence for advertisers who would otherwise pass over an opportunity to reach an engaged audience on a topic that means a lot to them. Seekr recently partnered with ad agency Oxford Road to bring more confidence to clients.

“When we move beyond the top 100 podcasts, it becomes infinitely more challenging for these long tails of podcasts to be discovered and monetized,” said Pat LaCroix, EVP, strategic partnerships at Seekr. “Media has a trust problem. We’re living in a time of content fragmentation, political polarization and misinformation. This is all leading to a complex and challenging environment for brands to navigate, especially in a channel where brand safety tools have been in the infancy stage.”

Dig deeper: 10 top marketing podcasts for 2024

The post Podcast Upfront highlights rebounding audiences and increased innovation appeared first on MarTech.